TORONTO, ON -- March 23, 2021 -- Irwin, a capital markets financial technology company, today announced the addition of two solutions designed to enhance its investor relations software capabilities. The NOBO (Non-Objecting Beneficial Owner) Solution enables issuers and advisors to identify and target retail investors, opaque institutions and family offices, and the Integrated Surveillance Solution provides a deeper level of insight into the changes within a company’s institutional investor base and the key factors driving them. Integrating with its core data and CRM, Irwin represents the most comprehensive and accurate shareholder intelligence on the market, giving companies the information they need to build stronger relationships with qualified investors using one central platform.

“Irwin’s capabilities enable issuers and advisors to understand how their shareholder base is evolving, monitor who is buying and selling, and target investors aligned with a company’s strategy, which is all critical for future growth,” said David Whyte, CEO and Co-Founder of Irwin. “Our software is the only answer for companies looking to receive accurate and timely insights into their entire shareholder base, including information about individual and opaque investors that has historically been difficult to access.”

While institutional investors are easier to track through public filings, NOBO lists are used to identify investors such as retail traders, family offices, smaller hedge funds, and asset managers. Irwin’s NOBO Solution gives companies beneficial information about these investors including names, addresses, and the number of shares they hold. It automates the ordering process and integrates the data into Irwin’s platform allowing issuers to receive lists on a more regular basis and easily track changes in investor activity over time. When comparing results from companies' normal reported filings, Irwin has found that on average, clients have seen a 78 per cent increase in the number of shares they are able to monitor with the inclusion of its NOBO Solution.

“NOBO lists include valuable shareholder insights but have been underutilized due to the time-consuming and manual effort required to order and make sense of the data. Irwin’s solution removes this significant source of frustration for issuers,” said Mark Fasken, COO and Co-Founder of Irwin. “Using machine learning technology, Irwin accurately cleanses and parses non-reporting holder data and integrates it with the rest of our client’s shareholder information to provide them with easy access to more intelligence than any other provider.”

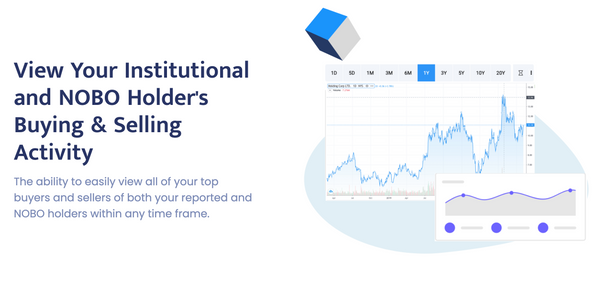

Surveillance provides frequent insight into a company’s top shareholder base and can be used to identify potential activist investors. Irwin’s Integrated Surveillance Solution allows for companies to receive weekly updates to changes in their shareholder base using data from leading surveillance providers around the world. As Irwin’s client base becomes increasingly global, this solution allows Irwin to partner with local surveillance providers who have expertise in that particular market.

Irwin client Kirk Coleman, CFO of TFF Pharmaceuticals, commented, “Time is an incredibly valuable resource to us as we continue to grow as a public company. With Irwin’s NOBO and Surveillance Solution, we’re able to quickly identify previously unknown buyers and sellers, avoiding potential missed opportunities to engage with shareholders, and easily track investor contacts and interactions for future follow-up. Irwin gives us the most complete view of our entire shareholder base in one central location.”

For more information, visit www.getirwin.com or connect with us on LinkedIn.

About Irwin

Irwin is a leading software provider enabling capital markets professionals to build stronger relationships with the investment community. Irwin creates simple solutions for global public companies and their advisors to uncover new potential investors and shareholders, with the end goal of delivering better stakeholder awareness, higher trading volumes, and more stable share prices. Combining best-in-class customer service with modern software and the most comprehensive shareholder intelligence on the market, Irwin helps inform strategic business decisions for thousands of users around the world. Irwin was founded in Toronto, Canada in March 2017.